On December 5, predictive analytics will be rolled out across our organization. We eagerly look forward to this rollout because it will enable us to issue contracts faster. This will have a positive impact on all new life insurance applications made using the electronic application.

What is predictive analytics?

Predictive analytics uses information submitted by the applicant to determine whether they can be

instantly eligible for life insurance coverage

solely by filling out the insurability questionnaire in the electronic application, without any further medical testing.

Eligible clients

The following clients qualify for our first predictive analytics model. These clients are in addition to those already eligible at the point of sale.

| Age | 18 to 50 |

| Type of coverage | Life insurance (participating, permanent, term and universal life) |

| Amount | $500,000 to $1,000,000 |

More decisions at point of sale

We anticipate that this predictive analysis model will increase the number of applications approved at point of sale to

more than 1 in 3.

More people insured on the spot!

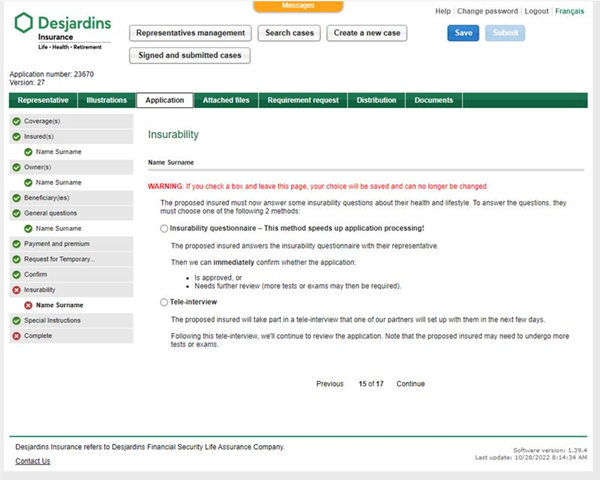

Insurability: questionnaire or teleinterview?

At the insurability stage, the member or client can complete the questionnaire or participate in a teleinterview, as shown in the figure below.

Once their choice is made, it cannot be changed.

Get faster results by completing the insurability questionnaire in the electronic application

It takes the same amount of time to complete the insurability questionnaire as it does to do a teleinterview. But applicants who complete the questionnaire will know right away if they are eligible for insurance. That's reassuring for them to know.

And even if their insurance application is not accepted immediately, the information collected in the questionnaire will speed up processing. This time savings could prompt your client to choose the insurance you offer rather than a competitor’s product.

Finally, due to the predictive analytics, using the insurability questionnaire will also reduce the number of people who need to meet medical requirements. Why not take advantage of the questionnaire option, especially since we're constantly improving it to make it easier to serve your clients.

Updated tools

Predictive analytics will be added to the requirements grids on this site and on Illustration.

FAQ

See the

frequently asked questions for more information on predictive analytics.

Questions?

New Business and Underwriting