Our line of participating whole life insurance products has been a hit, and we look forward to continuing to enhance it as we've done in recent years. With the launch of the 5 Pay PAR product in August 2022 and our competitive dividend scale interest rate increased to 6.2% in July 2023, our participating life insurance products stand out from the competition.

We're always looking for ways to improve and to make life easier for you and your clients, so we're enhancing the tools you use to offer participating whole life insurance products.

Starting November 7, 2023, you'll be able to use a new feature in the illustration software to

determine an insurance amount based on the premium.

You'll be able to enter the premium amount chosen by your client, and the illustration tool will calculate the coverage amount associated with the premium. That way, you'll avoid having to change the insurance amount multiple times to get to the premium your client wants.

Enjoy an improved experience when you offer participating whole life insurance!

How to determine an insurance amount based on the premium

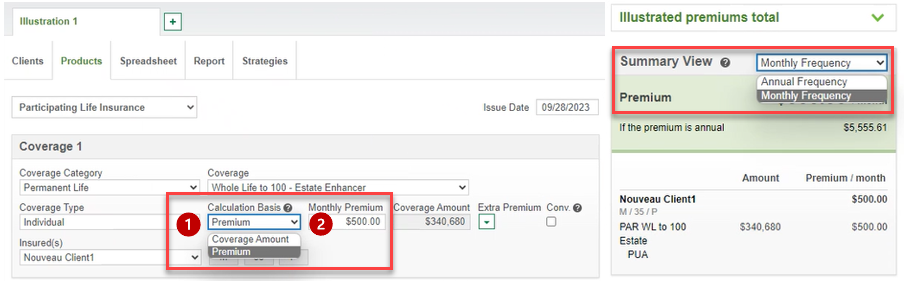

- In the

Calculation Basis dropdown menu, select

Premium.

- Enter the premium amount in the

Monthly Premium or

Annual Premium field, according to the frequency selected in

Summary View.

The insurance amount for the premium entered will automatically appear in the

Coverage Amount field.

Because of the way you normally work, the

Coverage Amount option is selected as the default

Calculation Basis.

Details on using the Premium as the Calculation Basis

The premium entered does not include the cost of the additional coverages selected. As needed to stick to the client's budget, you have to subtract the cost of any additional coverage selected.

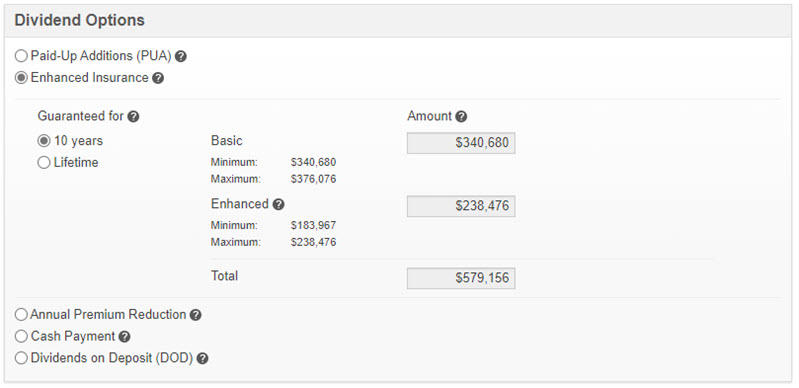

If the

Enhanced Insurance dividend option is selected, the tool automatically calculates the enhanced amount. That means minimum and maximum amounts are determined for both

Basic and

Enhanced insurance. You cannot modify the

Basic amount or the

Total. However, you can choose the

Guaranteed for amount (10 years or

Lifetime, except for the 5 Pay PAR product, for which only the

Lifetime option is available).

Financial needs analysis (FNA) is still essential

The FNA is an essential step in determining the insurance coverage required. You can use it to see the gap between your client's current situation and their actual insurance needs, and how to fill it. You can then recommend the right coverage for their insurance needs based on their financial situation.

Questions?

Contact our

Business development team - Insurance.